Latest posts

Consumers report a consistent quality experience with ExamOne

ExamOne's professional staff, options for convenience of screening locations, ease of scheduling, and the constant monitoring of multiple performance metrics help ensure that policy completion is not stalled or hindered, and applicant satisfaction is achieved.

White Paper: Optimum Life Re finds potential 2.5x increased detection of hepatitis B through an improved reflex rule

ExamOne® recently sought to produce a better reflex rule for hepatitis B screening in life insurance using predictive modeling. In a new study, Optimum Life Re evaluates the performance of the ExamOne model in comparison with conventional reflex rules that are solely based on the results of liver function tests.

Drinking and life insurance: Laboratory insights help identify the rising risk of alcohol abuse

A cost-effective test to identify and properly price alcohol risk is the blood alcohol concentration (BAC) assay. Simply adding this to your testing profile provides blood alcohol values and an indication of your applicant’s recent alcohol intake.

LabPiQture provides critical information regarding CKD to insurers

How can insurers quickly and confidently determine if their applicant has kidney disease? In a recent case study, we show how eGFR results highlighted in LabPiQture uncover or disprove chronic kidney disease.

Taking ExamOne to the NEXT LEVEL: employee awards and giving back at annual convention

Join us in appreciating our employees who won awards and those who demonstrated our commitment to our communities by giving back at our recent annual employee convention.

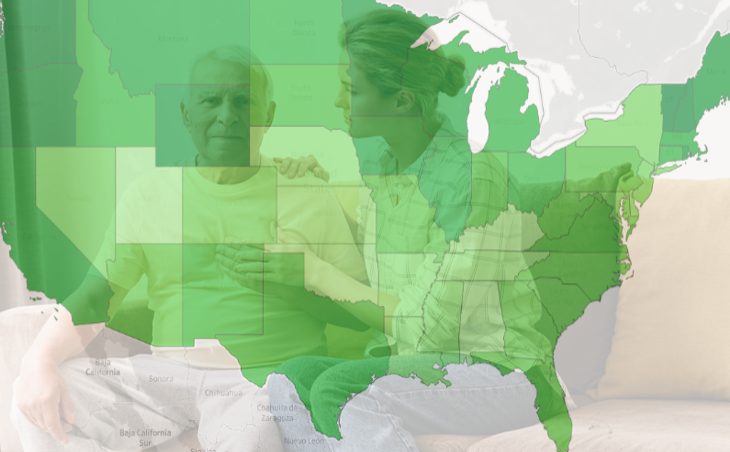

Mapping cholesterol trends for life insurance applicants

Laboratory results from a paramedical exam can help bring awareness of heart health issues to both life insurers and consumers. ExamOne discovers cholesterol trends for life insurance applicants.