Excessive alcohol use was responsible for about 178,000 deaths in the United States each year during 2020–2021, or 488 deaths per day. The CDC reports that this was a 29% increase from 2016–2017 and makes alcohol one of the leading preventable causes of death in the United States. This rising risk impacts life insurers’ bottom lines.

Identifying potential alcohol abusers

Traditionally, insurers have primarily relied on applicant self-admission, the MIB, motor vehicle reports (MVRs), and the occasional APS “surprise” to identify potential alcohol-related risks. But how effective are these tools?

One of the cost-effective tests to identify and properly price alcohol risk is the blood alcohol concentration (BAC) assay. Simply adding this to your testing profile provides blood alcohol values and an indication of your applicant’s recent alcohol intake.

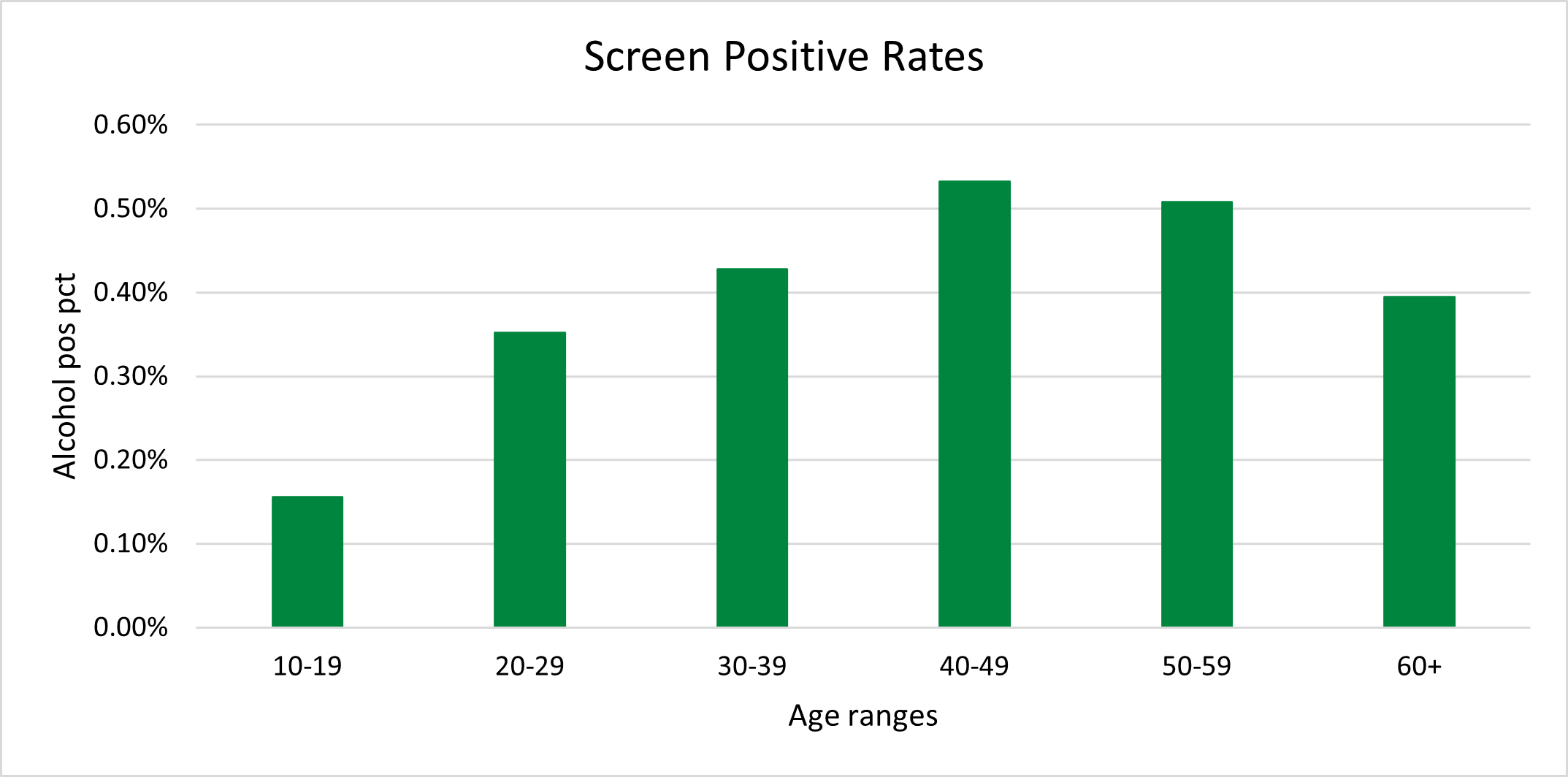

In an analysis of life insurance applicants by ExamOne’s analytic department, alcohol screening had a positivity rate of less than one percent. This is lower than marijuana and amphetamines, but higher than cocaine, methamphetamines, and morphine. A person who screens positive at the time of their exam has a blood alcohol concentration level above 10 mg/dL and most likely would have been drinking within five hours or less of the blood draw. Given that paramedical exams are typically scheduled well in advance and are most often performed during business hours on a weekday or early in the day on Saturday, a BAC elevation at the time of collection may be strongly suggestive of problematic alcohol use.

Impact of excessive drinking

The pandemic shined a light on the negative effects of mental health struggles and alcohol use. National Institutes of Health (NIH) research compared the number of alcohol-related deaths in 2019 with the number of similar deaths in 2020 (during the pandemic). The incidence of alcohol-related death was then compared with all other causes of death during that time. Alcohol-related deaths increased by 25%. Compared with all other causes of death, which increased by 16%, alcohol-related deaths increased at a higher rate.

More statistics from the CDC illustrate how excessive drinking that can impact an insurer’s bottom line.

- Excessive drinking shortened the lives of those who died by an average of 24 years, for a total of about 4 million years of potential life lost. These deaths result from conditions that develop from drinking over long periods of time from binge drinking—or drinking too much on one occasion.

- Two-thirds of the deaths (about 117,000 deaths) are due to chronic conditions that develop from long-term alcohol use, including various types of cancer, heart disease, liver disease, and alcohol use disorder.

- One-third of these deaths (about 61,000 deaths) happen from drinking too much on one occasion, such as from motor vehicle crashes, poisonings involving substances in addition to alcohol, and suicides.

Insights that can help cover costs

BAC testing provides insights for consideration during underwriting process testing and may help identify the rising risk of alcohol abuse. From conversation with our clients, our teams have heard that some clients have started screening all applicants and report that the savings in accidental death claims more than cover the cost of the testing. Depending on face amount distributions, detection of a single case declinable based on BAC may provide expected mortality savings more than equal to the cost of many months of testing.

If you are interested in adding this test to complement or enhance your current underwriting tools, please contact your Strategic Account Manage.

Find out more alcohol analysis from The Alcohol-Related Disease Impact (ARDI) application from the CDC, which is an online application that provides national and state estimates of alcohol-related health impacts, including deaths and years of potential life lost (YPLL). These estimates are calculated for 58 acute and chronic causes using alcohol-attributable fractions and are reported by age and sex.

Deaths from Excessive Alcohol Use in the United States | CDC

Excessive alcohol use was responsible for about 178,000 deaths in the United States each year during 2020–2021, or 488 deaths per day. The CDC reports that this was a 29% increase from 2016–2017 and makes alcohol one of the leading preventable causes of death in the United States. This rising risk impacts life insurers’ bottom lines.

Identifying potential alcohol abusers

Traditionally, insurers have primarily relied on applicant self-admission, the MIB, motor vehicle reports (MVRs), and the occasional APS “surprise” to identify potential alcohol-related risks. But how effective are these tools?

One of the cost-effective tests to identify and properly price alcohol risk is the blood alcohol concentration (BAC) assay. Simply adding this to your testing profile provides blood alcohol values and an indication of your applicant’s recent alcohol intake.

In an analysis of life insurance applicants by ExamOne’s analytic department, alcohol screening had a positivity rate of less than one percent. This is lower than marijuana and amphetamines, but higher than cocaine, methamphetamines, and morphine. A person who screens positive at the time of their exam has a blood alcohol concentration level above 10 mg/dL and most likely would have been drinking within five hours or less of the blood draw. Given that paramedical exams are typically scheduled well in advance and are most often performed during business hours on a weekday or early in the day on Saturday, a BAC elevation at the time of collection may be strongly suggestive of problematic alcohol use.

Impact of excessive drinking

The pandemic shined a light on the negative effects of mental health struggles and alcohol use. National Institutes of Health (NIH) research compared the number of alcohol-related deaths in 2019 with the number of similar deaths in 2020 (during the pandemic). The incidence of alcohol-related death was then compared with all other causes of death during that time. Alcohol-related deaths increased by 25%. Compared with all other causes of death, which increased by 16%, alcohol-related deaths increased at a higher rate.

More statistics from the CDC illustrate how excessive drinking that can impact an insurer’s bottom line.

Insights that can help cover costs

BAC testing provides insights for consideration during underwriting process testing and may help identify the rising risk of alcohol abuse. From conversation with our clients, our teams have heard that some clients have started screening all applicants and report that the savings in accidental death claims more than cover the cost of the testing. Depending on face amount distributions, detection of a single case declinable based on BAC may provide expected mortality savings more than equal to the cost of many months of testing.

If you are interested in adding this test to complement or enhance your current underwriting tools, please contact your Strategic Account Manage.

Find out more alcohol analysis from The Alcohol-Related Disease Impact (ARDI) application from the CDC, which is an online application that provides national and state estimates of alcohol-related health impacts, including deaths and years of potential life lost (YPLL). These estimates are calculated for 58 acute and chronic causes using alcohol-attributable fractions and are reported by age and sex.

Deaths from Excessive Alcohol Use in the United States | CDC