Are we creating demand or creating distrust? I have been pondering that question as it relates to the life insurance industry for a while now. It seems to me it is the crux of the issue. Do we stimulate the need for the product in a trustworthy and noble way or have we been missing the boat and unknowingly creating distrust? If it isn’t distrust we are creating, then why is our industry at a 60 year low watermark? What can we do to change the trend? Is it interest rates, underwriting, distribution, the products? Or can it be that we are actually doing everything correctly and it is the consumer that doesn’t get it?

Can we agree we live and work in a highly social and consumer-driven economy? Is it safe to say the internet changed it all? Did the internet allow everyone to have a voice and when it did, did their voices say “No” to the way we had always done it in the life insurance industry? If their digital voices could be heard the noise would be deafening. We literally could not hear ourselves think because of how loud the simultaneous and repeated “No” would sound. If we could not hear ourselves think, maybe it would startle us enough to change course and change it quickly.

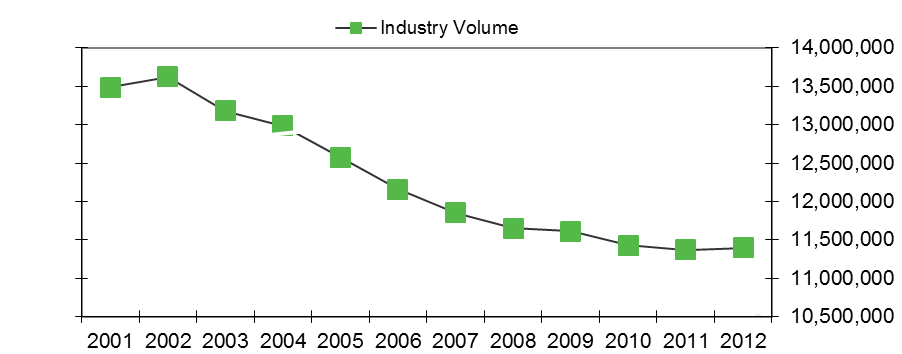

Change is something that is hard for most of us and has been particularly hard for our industry. Even without answering these questions, one piece of information is undeniable. Our industry trends are pointing down. That fact alone should be a great place to start asking ourselves a few questions.

Do we really know our clients and their applicants? How much direct consumer knowledge do we really have? Do we still rely on what agents tell us consumers think without digging deeper? Have we really committed to agent education? Is our sales and distribution team simply an expense? Is it something to be nurtured or something we live with?

Do we have social media strategy? Why? Why not? How are we measuring it? What does it even mean…really…it is still vague and constantly changing, but is it good enough to just hope it becomes clear one day?

Does offering a simplified issue product build trust or distrust? What does it communicate? Did the internet allow more knowledge about product and pricing to be transparent? If it did, would that knowledge make a consumer trust us more?

These are just a few of the questions our team has been debating over the last few years. In the next article I will share some of the ideas and solutions to these problems that our team has discussed. We need to change the fact that we are at a 60 year low in life insurance ownership and help consumers realize the importance of life insurance, as well as build their trust.

What do YOU think?

Do you agree with these questions? Should we be asking different questions? What do you feel the biggest challenge our industry is facing today? Submit your thoughts here.

Are we creating demand or creating distrust? I have been pondering that question as it relates to the life insurance industry for a while now. It seems to me it is the crux of the issue. Do we stimulate the need for the product in a trustworthy and noble way or have we been missing the boat and unknowingly creating distrust? If it isn’t distrust we are creating, then why is our industry at a 60 year low watermark? What can we do to change the trend? Is it interest rates, underwriting, distribution, the products? Or can it be that we are actually doing everything correctly and it is the consumer that doesn’t get it?

Can we agree we live and work in a highly social and consumer-driven economy? Is it safe to say the internet changed it all? Did the internet allow everyone to have a voice and when it did, did their voices say “No” to the way we had always done it in the life insurance industry? If their digital voices could be heard the noise would be deafening. We literally could not hear ourselves think because of how loud the simultaneous and repeated “No” would sound. If we could not hear ourselves think, maybe it would startle us enough to change course and change it quickly.

Change is something that is hard for most of us and has been particularly hard for our industry. Even without answering these questions, one piece of information is undeniable. Our industry trends are pointing down. That fact alone should be a great place to start asking ourselves a few questions.

Do we really know our clients and their applicants? How much direct consumer knowledge do we really have? Do we still rely on what agents tell us consumers think without digging deeper? Have we really committed to agent education? Is our sales and distribution team simply an expense? Is it something to be nurtured or something we live with?

Do we have social media strategy? Why? Why not? How are we measuring it? What does it even mean…really…it is still vague and constantly changing, but is it good enough to just hope it becomes clear one day?

Does offering a simplified issue product build trust or distrust? What does it communicate? Did the internet allow more knowledge about product and pricing to be transparent? If it did, would that knowledge make a consumer trust us more?

These are just a few of the questions our team has been debating over the last few years. In the next article I will share some of the ideas and solutions to these problems that our team has discussed. We need to change the fact that we are at a 60 year low in life insurance ownership and help consumers realize the importance of life insurance, as well as build their trust.

What do YOU think?

Do you agree with these questions? Should we be asking different questions? What do you feel the biggest challenge our industry is facing today? Submit your thoughts here.