I have an analogy that I have been using more often lately. It goes like this: A critically injured man is rushed into the emergency room and the doctor needs to run tests to save his life so he yells, “FICO score, stat!” It usually gets a laugh or two, but the very real issue of undermining the value of vital health data in our industry is not funny at all. The current state of our business that elicits this anecdote is just one of the reasons we are evolving our offerings and launching a significant enhancement to our Policy Express process.

The new Policy Express workflow—Policy Express 2.0—will continue to push our industry towards a more consumer-oriented process that’s quicker and provides a more individualized approach to risk determination. Not only is it more accurate and efficient, it also has the best opportunity of resulting in the best premium offer for each applicant. Consumers benefit from our process that doesn’t rely solely on lifestyle information versus health data to determine their health status.

The new Policy Express workflow—Policy Express 2.0—will continue to push our industry towards a more consumer-oriented process that’s quicker and provides a more individualized approach to risk determination. Not only is it more accurate and efficient, it also has the best opportunity of resulting in the best premium offer for each applicant. Consumers benefit from our process that doesn’t rely solely on lifestyle information versus health data to determine their health status.

It’s a win-win. We provide the requirements and protective value to give consumers better, fairer pricing. Insurance companies receive the needed health information to price competitively while still protecting their company’s applicant mortality risk and ultimately long-term future. Since life insurance isn’t just for the ultra-healthy or ultra-wealthy, new processes must be transparent and fair for all parties.

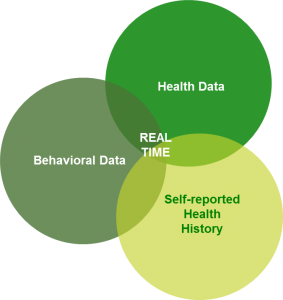

Utilizing the powerful combination of health, behavioral, and self-reported health history data, Policy Express 2.0 positions us all to build the most precise risk profiles for applicants while still achieving a faster, more personalized risk assessment. The real-time triage workflow provides health data that can be used to quickly approve, decline or send applicants through to next steps of laboratory testing and Risk IQ scoring. It also helps in finding the “Hidden Healthy” and creating robust profiles for applicants who need more detailed assessments.

I will always put more trust and faith in underwriting decisions obtained from results that include a complete health analysis with laboratory testing. But as we built Policy Express 2.0., it made the radical industry shift away from the proven standard more apparent to me. Ultimately, we have to ask ourselves if these changes are good for us, our industry, and applicants. I want to spend more time addressing some of these new concerns in more detail in a future blog article. However, for now excuse my spoiler alert, but there is no question we all are going to have to change… “Stat!”

I have an analogy that I have been using more often lately. It goes like this: A critically injured man is rushed into the emergency room and the doctor needs to run tests to save his life so he yells, “FICO score, stat!” It usually gets a laugh or two, but the very real issue of undermining the value of vital health data in our industry is not funny at all. The current state of our business that elicits this anecdote is just one of the reasons we are evolving our offerings and launching a significant enhancement to our Policy Express process.

It’s a win-win. We provide the requirements and protective value to give consumers better, fairer pricing. Insurance companies receive the needed health information to price competitively while still protecting their company’s applicant mortality risk and ultimately long-term future. Since life insurance isn’t just for the ultra-healthy or ultra-wealthy, new processes must be transparent and fair for all parties.

Utilizing the powerful combination of health, behavioral, and self-reported health history data, Policy Express 2.0 positions us all to build the most precise risk profiles for applicants while still achieving a faster, more personalized risk assessment. The real-time triage workflow provides health data that can be used to quickly approve, decline or send applicants through to next steps of laboratory testing and Risk IQ scoring. It also helps in finding the “Hidden Healthy” and creating robust profiles for applicants who need more detailed assessments.

I will always put more trust and faith in underwriting decisions obtained from results that include a complete health analysis with laboratory testing. But as we built Policy Express 2.0., it made the radical industry shift away from the proven standard more apparent to me. Ultimately, we have to ask ourselves if these changes are good for us, our industry, and applicants. I want to spend more time addressing some of these new concerns in more detail in a future blog article. However, for now excuse my spoiler alert, but there is no question we all are going to have to change… “Stat!”